Doug Fritz, President & Founder of F2 Strategy, and Jerry Michael, President of Smartleaf Asset Management (SAM), discuss the benefits and challenges of implementing direct indexing.

This is a transcript of “A Primer on Implementing Direct Indexing”, a conversation between Jerry Michael, President of Smartleaf Asset Management (SAM) and Doug Fritz, President & Founder of F2 Strategy. Doug and Jerry discussed the benefits and challenges of implementing direct indexes. The webinar originally broadcast on Friday, May 21st. The transcript has been edited for clarity and content.

Today, we are joined by Jerry Michael, President of Smartleaf Asset Management and Doug Fritz, President & Founder of F2 Strategy. So, Doug, I will turn it over to you.

Doug Fritz: Awesome. Thank you so much. And Jerry, welcome to our webinar about direct indexing. I'm excited to be here. You and I have a long history and have been friends for a very, very long time. And, and we were joking before this, that this is like a bunch of people get to watch what Jerry and Doug do frequently, which is just get on the phone — and now on video — and talk about things that are going on in the industry, their impact on advisory firms, F2’s clients and just the trajectory of our industry.

And this is one where you and I spent a lot of time over the last year talking about direct indexing. And it's just fun to spend some time with you and talk about this and the things that we talk about all the time. Just bringing other folks up to speed on this.

So I think let's just jump right into it, right? I think from a layman's perspective, if anybody's on the phone that's an advisor, an independent advisor or a wirehouse advisor hearing about this, give us a sense, like the high-level Wikipedia version, of what a direct index is.

Gerard Michael: It's a kind of a back-to-the future idea, where investors directly own the stocks. It's basically an unbundled ETF. If you buy an ETF, you indirectly own IBM and Ford and Walmart. With a direct index you just own IBM, Ford and Walmart. So same idea, just the stocks are yours directly, instead of only owning one share of the ETF and indirectly owning a bunch of stocks.

Doug Fritz: And what happened that brought us back-to-the-future, right back to the 1970s, where we're buying individual stocks. How on earth are we now doing this again? This doesn't overtly make much sense.

Gerard Michael: Well, it's actually not a new idea. And even in 1970, if you were wealthy enough, you owned direct indexes. You owned the stocks yourself. Mutual funds were great for ordinary human beings. And the reason was the bid-ask spreads were much, much higher and institutions got much, much better execution. Commissions could be $200 a trade. And that would just kill you if you were an individual investor.

Well, a number of things are happening. I think bid-ask spreads on shares are something like 1/100th of what they were in 1970. Now we have things like $0 commissions and, coming soon, fractional shares. So now all of a sudden something that was the exclusive preserve of really wealthy institutions or really wealthy individuals, I think it's coming to the point where the average investor can actually own these things.

And they've always been a good idea. If you could just get past the trading costs, the bid-ask spread, the commissions, and of course, having someone manage them for you, which is its own issue.

Doug Fritz: It is kind of fascinating, both that the cost of things and the automation of things have come so far down that we're back to owning individual securities and all the other things that go on with that.

But why right now? Funds are great. ETFs are fantastic. Why is the direct index concept hot right now? What is driving it as a concept, what's driving the sizzle?

Gerard Michael: I think the draw, the actual driver for right now, was the announcement last year by all the major custodians that they were going to support $0 commissions and fractional shares. And by fractional shares, I mean you can own 1/1000th of a share of IBM. It opens up the possibility that direct indexes will simply replace ETFs and mutual funds, not just for the super elite, not just for the Bill Gateses of the world, but for the average investor. Your default product, your default solution, won't be the ETF. Your default solution will become the direct index because for reasons we haven't really discussed, they're better. They're better than an ETF.

Doug Fritz: How do they perform better? How are they better than ETFs for the average advisor looking at this, talking to their clients about it? Why would they be better?

Gerard Michael: Yeah, and this is not new. This was true for, whoever it was, a rich person, back in 1970.

They are more tax efficient. There’re little things like, if you have 100 stocks, you can do more tax loss harvesting than if you own just one ETF. They're better for transition.

You can customize them. Everything you hear about ESG — say you want to have a green practices screen. Well, you can do that with a direct index. It's your stocks. You can do risk customization. If you work for Exxon, you may like your company, but you have enough exposure as is to the fortunes of Exxon corporation, so it’s probably prudent from an investment perspective not to own anymore of it. Well, you can do that with a direct index. You can't call up your ETF and say, great job guys, but could you hold off on tobacco stocks and Exxon? With an ETF, you can do all of this.

The real headline is that ETFs and index mutual funds already outperform 80 to 90% of all investments on an after-tax basis, but a direct index, well-managed at a reasonable cost, will outperform an ETF on an after-tax expected basis. It's simply the best investment out there.

Doug Fritz: I wonder what happens in this movement? When folks look at this, at the increased level of customization, the ability to manage taxes, which is especially important right now going into 2021, what does this do to the mutual fund industry and the ETF industry? Are advisors you're going to drink the milkshake of all the asset management firms? How do asset management firms play in this space? A mutual fund, I get it. There's some IP. There's some logic. There they're making trades, or they're striving for alpha. But from the massive ETF industry, what does this do to that industry?

Gerard Michael: I think that's really interesting. We've spoken with a number of asset management firms, and more than one mutual fund company has said to me, and I am quoting directly, “mutual funds are dead”. That's coming from a mutual fund company. I think they recognize direct indexes are just a better investment. People use the word direct “indexing”, which suggests direct indexes are always passive, but the concept of unbundling the ETF and mutual fund is perfectly general. You can do the exact same thing for an active strategy. Take your active mutual fund and just unbundle it and have the investors own the stocks directly.

It still leaves a role for the asset managers, but what asset managers recognize is their business has to change. And what we're hearing from them is they think, and I'm going to use their language, that they have to move up the value chain. I know it's a bit of jargon, but that's what we hear. Asset managers want to offer advice on entire asset allocations, not just, “here's a large cap product, here's a mid-cap product.” They'll offer entire asset allocations, like “aggressive growth” or “conservative”. They'll take on the rebalancing, even though every individual investor owns the stocks directly. They'll manage each individual account, with lots of tax management and lots of customization.

And there's also the possibility you can have a thousand flowers blooming, you can have all the strategies you want. If you have some bright, new idea, launching a new mutual fund or ETF can take six months and a million dollars. But if asset managers are just feeding people models, they can do it in a day. So I think direct indexing does open the possibility of a more nimbler industry that can respond to people's needs more quickly, though I think this value proposition is more theoretical.

Doug Fritz: There are massive asset management shops, and there are boutique, new, great approach, smaller asset management shops. The big guys have the ability to be the platform, that “up the value chain” concept. They're going to get there. They're already on their way. If you look at some of the acquisitions that these firms are making, rebalancing tools, movement into the model marketplace UMA space, which is sort of the gravel road before the paved road. The big folks are already getting it.

But I worry about the smaller folks. I think there's mechanisms that they can leverage to also play in this space. And maybe with direct indexing, they have a new marketplace. It's hard to hire a bunch of wholesalers and ship them around the country to get people stoked on your mid-cap value strategy. But if performance is good and your strategy is good, if you can get it into direct indexing model marketplaces, maybe that is a shorter path to prominence and relevancy. How do you see the big/small paradigm breaking?

Gerard Michael: I think in some ways this is really good news for the small guy. All they have to do is deliver the direct indexes, a weighted list of securities. It's their intellectual capital. If they have to actually go create a mutual fund, well, they just get killed. They don't have the infrastructure for it, which means their mutual funds are really expensive because they just don't have economies of scale. But there's no economy of scale necessary to send a weighted list of securities, so for innovative companies — and I think you're seeing that in the ESG space — the barriers to entry collapse. It doesn't mean the big firms are in trouble, but if you're a real boutique and you specialize in something, there's no barrier to getting your ideas out there. So I think it's actually a good thing for them.

Doug Fritz: Thinking through the concept of moving towards direct indexes and using them with clients, I think there is a hurdle — I think it can be overcome, because we've done this when we moved from funds to SMAs, which is similar.

A fund has a cost that clients don't see because it's embedded in the fund, and we can overlay our advisory fee on top of that. You see stories of folks that are paying 200 basis points all in for the advice from some advisor who think that they're getting it for free or think that they're getting their advice for a hundred basis points but they have a whole stack of additional fees in the fund structure. Getting out of funds and ETFs and into a direct index, clients are going to see the direct index part of the advisory fee as an actual line item on their statement. I worry that an advisor would look at that and say, yeah, I know in theory direct indexes cost less for my clients, it’s better for them, but I'm not going to show them this fee. I'm not ready for that conversation. Do you think that would hold people back from deploying direct to direct indexes or not?

Gerard Michael: I do. I think you've nailed it. I think it's the single weakness of direct indexes. There are things structurally that need to happen — and we can get into that — before direct indexes can be deployed by the average advisor at scale. We're not entirely there yet, but it's coming.

But there's one possibly permanent drawback of direct indexes, and you've nailed it. Even though direct indexes should come in at less total costs than mutual funds. Even though they should come in at less total cost than most ETFs. Even though they're intrinsically a less expensive offering, the fee isn't hidden. And so indeed you have this issue. If you're an advisor, the mutual fund fee is buried in the net asset value. With a direct index, it's going to show right up there on the line item. So, the direct index is wholly better for the investor. It costs less. It will outperform even the identical strategy on an after-tax basis and probably by a fairly large amount. But, yes, there’s an issue with the transparency of the fees.

It’s going to take some change in the industry for people to really get the message across that mutual fees are hidden; direct index fees aren’t hidden, but they’re cheaper overall. I think the fee transparency issue can be overcome, but I agree it's the single greatest weakness of direct indexes.

Doug Fritz: If I was an advisor and interested in using a direct index or getting there do I substitute out the funds that I've got in ETFs? I've got this stable of twenty funds and ETFs and almost every single one of my client portfolios has these funds. Do I swap them out? Or is this an additional thing? How do I think about moving in this direction? Is it a swap and replace, or is it an addition to what I'm doing for my clients?

Gerard Michael: Putting aside transition management, on a go-forward basis, it's swap and replace. You take that mutual fund and if there's an equivalent direct index, just replace it. The client is better off in every way. Direct indexes really are substitutes.

The way this should work is, for a client who is really, really small — a $200 account — you still use ETFs or mutual funds. For anyone else, putting transition issues aside, going forward replace the ETFs and mutual funds with direct indexes. At least for major asset classes — that’s US large cap, US mid cap, probably US small cap and even a foreign ADR-based direct index. You probably don't want to use them for emerging market debt, but for the major asset classes that constitute the majority of the client's assets, certainly on the equity side, they're just better.

Doug Fritz: That's a good point. You can’t use direct indexes for everything in your portfolio. I don't think you can really direct index bonds. Someday the amount of liquidity and access to inventory on corporate bonds might be good enough to do that, but it's predominantly liquid equities. Can you create a direct index alternative for every ETF? Could you use direct indexes to replace sector ETFs?

What about client fit? Is the direct index concept great for the small accounts, because historically those are the ones where I’ve deployed ETFs, and direct indexes are now a better, lower cost, more fine-tuned way to deliver great advice? But maybe with my $10 million and above clients I'm not using direct indexes? Or would I use direct indexes for both? Is it a small account or a big account solution?

Gerard Michael: It’s both. Historically large accounts have always used direct indexes – I’m just going to use “direct index” as a placeholder for an unbundled mutual fund or unbundled ETF — if you were wealthy enough, you've always had it. It's not actually a new idea. The new idea is that it's for everyone. What's changing is that it is becoming a perfectly viable alternative for even really small investors. This does require the $0 commissions and fractional shares. Without that there is a limit on the minimum account size that can use direct indexing. We see clients with as little as $50,000 using direct indexes without fractional shares, but with fractional shares, anyone with $50 can have a direct index.

You asked earlier, why now? It's because fractional shares and $0 commissions make direct indexes universal. ETF gets replaced by direct indexes everywhere.

Doug Fritz: $0 commissions. That's here. We're experiencing that now. That's fantastic. With fractional shares, where are we? Are there any national players supporting fractional shares? Apex Clearing and some of the newer custodians automatically do this, but where are the rest of the custodians and broker dealers in terms of their support of fractional shares? I don't think everybody's there yet, and there may be some players that are going to take years to get there. Does that produce competition among custodians in the custodial wars?

Gerard Michael: It does. I think there are interesting things going on. A number of custodians already offer it for retail investors, but for sub-advisors, they're not quite there. So yeah, it's in progress. As you say, there are some people like Apex who are already there. Apex just went public for some extraordinary premium, and I think that's why. They're ahead of the game in terms of actually offering fractional shares at scale. I think people are looking at that and saying, “hey, they have a semi monopoly for a while,” which is interesting. But the others will catch up.

Doug Fritz: Awesome. A question from the audience — audience questions are great and this is why we allow this: what are the most common indexes that people use for direct indexing? Would it just be the S&P 500? Or sector indexes? Or maybe even something like a Fama-French DFA replication kind of index?

Gerard Michael: The answer is they can have all of those. They’re all possible. But, of course, since the US large cap is the largest component of most portfolios, that ends up being the most common direct index. US large cap is common, mid cap sometimes, small cap sometimes, foreign using ADRs. Within US large cap, it could just be something that tracks the S&P 500 or something of that sort, but If you want to have a value tilt, a growth tilt, that's all possible. In fact, the choice is greater than the choice of ETFs, because it's so much easier to create a new direct index. Whether the world needs more choice along those lines I'm going to stay neutral on, but the possibility is there.

Doug Fritz: Maybe as long as I've been alive, there’s been a perception that increased customization and bespoke portfolio construction leads to more clients, winning more. I think that's proven out, and it's definitely come as a feedback from all of the advisor surveys that we've done, that, boy, if I just had more ability to customize I’d win more clients.

On the implementation side, let's get into the tactics of how people adopt direct indexing, because it is rapidly moving from theoretical to tactical. If I have a Tamarac or if I had a rebalancing tool on my desktop, is that what I need to do direct indexing or do I need something else?

Gerard Michael: Before I get to that, I'd like to take up something you said earlier, which is, hey, customization is good, which attracts clients.

You asked in the very beginning, “why now?” I think there's something else going on which is driving the adoption of direct indexes. And that's the decline of value propositions based on product and trades and performance – the idea that your advisor is kind of a little mini hedge fund, the idea that your advisor is there to beat the market by 40% and talk to you about whatever Cramer said on TV last night. I think that notion, really a brokerage model, really, is dying. There is, across the board, a growing recognition that the advisor adds greater value, not by trying to beat the market, but by taking on the role of the client's lifetime financial coach. And then things like tax management, which maybe could be ignored if I’m trying to beat the market by 40%, matter. Taxes matter and risk customization matters. So it's not just that clients respond to customization and tax. I think the whole industry is moving to tax and customization as a central value proposition, as part of this adoption of a different business model, a different value proposition. Direct indexes play directly into this larger industry trend.

But to your second question, which is, hey, I've got a rebalancing system. Am I good to go? The answer is probably no. The whole point of owning direct indexes is that they can be customized and tax managed, and you want to be able to do that at scale. It should be no harder to manage a direct index than an ETF. And that's technically possible. That's doable, and that's doable today. But it's not doable with most of the current systems people have. So, can I just take my current systems and just use it to replace my ETFs with direct indexes across the board? Probably not. You'll either have to upgrade your tech or you might choose, even if you haven't done so in the past, to start outsourcing – just hand this over to somebody else so you can focus on more important things.

Doug Fritz: A direct index could be as simple as just owning the S&P 500. With zero dollar commissions and a fractional share ability, you could own the entire S&P even for a client that was very, very small. However, I think the value of a direct index comes from doing something else with it, right? It's not just owning the index. It's that you can do more things with it. You can do tax optimization, customization, and concentrated position management. You create an S&P 500-like return, but with additional customization, like ESG customization, and tax optimization. What other values are there to the direct index for an advisory firm, if it's not just to own the S&P index? Is there any kind of other draw?

Gerard Michael: Well, the larger point is that if you just own the stocks and then just walk away, you'll get very little value. You might as well buy the ETF. You have to garden the portfolio to get that value. Part of this is tax management. If you're going to customize, you’ve got to manage it. If you want an ESG screen, that’s fine. But you’ve got to manage that, you have to manage the risk created by the ESG restrictions. You have to rebalance and then you have to worry about trade-offs between managing tax versus managing drift.

There are tools that can automate all that, so it doesn't have to be painful. But just buying the direct index and saying, look at that, I have a direct index — I think you will have accomplished more or less nothing. So when people ask “can I do it with my current technology?”, the answer is probably not. Could you, with your current tech stack, just buy 500 stocks and mimic the S&P 500 exactly? Yes, but I don't think you would have accomplished much by doing so.

It's all the other stuff that you’ve got to do. And you have to be able to do it without pain. The solution can't be “I’ll just hire six more people to do it for me”. That would just sink the whole task.

It has to be as easy as managing an ETF, but with all the tax and all the customization.

Doug Fritz: That's a really, really good point.

When I'm used to working with my client and being accountable as an advisor for the decisions in the portfolio — why we made trades, why we changed allocation, what our forward-looking market assumptions are — I can control that, which means that when I sit down and talk to my clients, I can have this great conversation about why, what happened, what did we do. I can tell the full story. That telling of the rear view mirror story is really critical to a lot of advisors.

Going into SMAs, that was a big leap for people who were previously managing security stocks and bonds for clients. But the advisor at least could say, look, they've got a great track record. They're supposed to perform really well in the market we think is coming up. We've got conviction in them. We're going to keep them. I don't necessarily need to tell you the story about what they bought and sold and why, but I can tell you their theology is correct. Their take on inflation and the next 12 to 24 months in the economy is correct. We're still backing this fund or strategy.

But when we get into telling the story of a direct index portfolio, we have layers of stuff, right? We have now the layer of the stock index, we have the layer of an ESG screen and we have layers of concentrated positions. How do we tell the story? It’s a leap farther for an advisor to say, now I've got to go tell the story of all this stuff? That could be hard for me.

How would you coach advisors? You've got a lot of advisors getting into this space. How do they tell the story, if maybe they don’t have all the details of what happened and why?

Gerard Michael: I think this is not only a good point, I think it's the central point.

We began by saying that direct indexes are simply unbundled ETFs, and they’re a better way to invest. That doesn't sound too complicated. But when you start getting down to how to implement it, it turns out you need new systems. But there's something even deeper. And I think you've gotten at it. The actual client relationship starts to change. I think in a very positive way, but it does change.

You may have noticed, innocently, we started pulling on the thread of a sweater, and now the whole sweater is unraveling — unraveled sweaters are a bad outcome, and I think this is a good outcome, so maybe not a perfect metaphor, but put that aside — for a lot of advisors, the portfolio was really just a series of trades, and you could view a client meeting as an exercise in opening up a memorabilia book. Remember when we bought Ford? And, remember when we sold whatever it was? Well, that type of relationship doesn't exist anymore. It won’t be what client relationships will be about. Most advisors who are client facing shouldn't be rebalancing the portfolio at all. That should be done by a specialist, and the advisor should be freed up to be a coach, to be a financial planner. So, what advisors talk about starts to change.

The advisor may be talking mostly about financial planning, but even conversations about the portfolio will be different. Instead of discussions of trades, the advisor will talk about promises kept and value delivered. You asked for a Catholic screen? Well, we gave you a Catholic screen. I said, I would tax manage. Well, this is how much I saved you in taxes. (By the way, if the advisor is managing taxes well, a reasonable expectation is that the amount they save their clients in taxes will likely be larger than the advisor’s fee. Sharing that with clients is a nice way to start a client meeting.) And we customized your portfolio holdings to exclude the real estate sector because I know that you have outside holdings in a real estate limited partnership. We also left out Exxon because you work for Exxon and so you've already got enough exposure to their fortunes. The advisor is telling the client all the things I promised to do and then showing I did all those things.

But, no, they're not really talking about Ford or Walmart or whatever Cramer said on TV last night. That’s a change. They're not even talking about the same thing anymore. I think they're talking about things that are more important, which is, “did I do what I promised to with respect to these things which are important, like risk, taxes, and ESG restrictions?”

So yeah, it's a shift, but I think it's going to happen because direct indexing is simply a better investment approach.

Doug Fritz: I think you're right. And what will happen, the thing that will push this is that advisor A in the east side of Iowa City has this and is able to do these fantastic things for clients at lower cost. And so the sales pitch is now at $750,000 you're getting the same portfolio that I was giving my $10 million clients last year. The quality and the efficiency of the portfolio is better. And advisor B on the west side of Iowa City is still slinging funds and ETFs and telling the story okay but not competing on price, not competing on customization. And, the moment it leaks out that someone across the street is doing this better and cheaper, I’ve got to follow. And I think that will happen.

As this progresses, what will happen around reporting? I think that could be awesome. It's not exactly there yet, but reporting to be able to say, here's the return of the portfolio, rock and roll. But here's how the customization paid off. Here's where your carbon exposure was. Here's where it is now. The risk and return has stayed the same, but we've actually moved the needle on ESG. Here's, to your point here, how much we saved you in taxes. And here's how tax efficient the portfolio is right now and here’s how we're going to achieve additional tax alpha in the portfolio over the next six months.

With direct indexing, the portfolios are running algorithmically, really. You set the parameters you want, but the direct indexing tech that you need to really run this at scale has to run algorithmically. It can't just be that you’re sitting there, cherry picking Coke and Pepsi all day long anymore. And that does give us an opportunity to deploy some of the technology to say what happened and why, and actually tell the story for the advisor. A lot of times advisors are going to have no other way to find it out. The computer made a decision somewhere down in the code. Anyway, I think it's going to certainly change the performance conversation with clients.

Doug Fritz: One of the questions we’re getting from a listener is around dividends and how that works. It's probably a good question to talk about.

Gerard Michael: Let me answer that very quickly. Dividends work no differently than before. They will be reinvested in the portfolio to maintain the portfolio's target asset allocation and security weights, and that can be done automatically.

But Doug, I want to get back to something, you talked about advisor A and Advisor B in Iowa. I want to tell a story. I don't know if I have the ability to look straight in the camera, look ominous and say, be afraid, be very afraid. There. Was that effective?

Doug Fritz: Fear does not sell, Jerry. Inspiration sells. We're selling doing better for our clients.

Gerard Michael: Alright. Let me tell a story which is a real live example. Back in March, 2020, the markets went crazy. They became volatile, they collapsed. So, we know a firm, direct indexers. Portfolios with direct index cores, that's how they operate. Because they had automated the operations and the frontline advisors weren't managing portfolios, they made it a policy to reach out to every single client last March five times. They could do this precisely because their advisors were not scrambling rebalancing portfolios. They said to their clients, this is what we’re going to do. We're going to do loss harvesting, and we're going to make sure the risk characteristics of your portfolio stay the way they are supposed to be. They rebalanced every taxable account. One guy in a central rebalancing group did all that. And at the end of the month, they called all their clients and said “we did a lot of tax-loss harvesting. Assuming you can use these losses to offset gains, they’ll add 3.5% of your portfolio’s value after tax. So, we just gave you 3.5% back, kind of like a rebate on this market decline. And then of course the whole portfolio went back, by summer. and they still have this 3.5% sort of bonus. At the same time, they actually reduced the overall dispersion of returns. This was in March of 2020.

Other firms basically hid under their desk because they had no real ability to manage the portfolios. They had no real statement of the value they could add during a financial crisis. Here’s the kicker. This firm reports that their wallet share increased in the first six months of 2020. In fact, they got a greater inflow of wallet share in the first half of 2020 than the previous 18 months combined. And it was just because of what you said: they were able to say, this is what I did for you. One, we did all these things. And, two, here's the metrics. Yes, we did tax-loss harvesting. Here is the measure of how much value that was added. And at all times they can show we never violated your Catholic screen. We never bought X. We did all of those things that you asked us to do.

That ability to do what you say, make firm commitments and then prove that you kept them: it’s a game changer. Yes. Adviser A is going to win over advisor B.

Doug Fritz: Hey, I love this. The primer is great. But if I was watching this webinar, I would want to see it in action. Can you show me that this is actually possible and that Doug and Jerry aren’t just talking about some hypothetical thing that doesn't actually exist? Can you demo a little bit of what Smartleaf Asset Management does, so you can see this in action? I think it'll be super relevant to this conversation just to show us what it actually looks like.

Gerard Michael: What I can show is what the advisor sees and how the advisor interacts with those who are rebalancing the portfolios.

Let’s start by describing the advisor’s role in managing portfolios with direct indexes. I do think that most advisors should not be rebalancing portfolios themselves. It's just a waste of their time. They have so much more valuable things to do. If you think about it, this means there’s something odd about direct indexing. On the one hand, it's a little bit too complex for most advisors to do themselves, or it’s too time-consuming, so they shouldn't do it. At the same time, the whole point of direct indexing is customization and tax management.

So, we’re saying two things simultaneously: that advisors should hand over rebalancing to somebody else — it could be a central group. It could be outsourced. At the same time, we’re saying there should be more customization and tax management. Most people would respond, “Wait a minute, make up your mind. Which one do you want? Because if I outsource, if I hand it over to somebody else, I can't do customization and tax anymore. I'm going to get a cookie-cutter solution, which kills the whole point of the direct index in the first place.” It appears that there's a contradiction here. But there's an answer. There isn't a contradiction. By handing rebalancing over to somebody else, the advisor gets to increase the level of customization and tax. They get to really, really increase the customization because from their perspective, it's free. It's just a statement of what they want. Imagine you had a brilliant administrative assistant, and you could just tell your administrative assistant, “this is the Smith account. They want a Catholic screen. They don't want real estate. They want, whatever.” And your great administrative assistant just did it for you. That doesn't limit the amount of customization you can do. It increases it because you just get to tell your poor suffering administrative assistant whatever you want done.

Well, this is a decent simile for how direct indexing works. The way that the advisor interacts with the world is they say, “This is the Smith account. And this is everything I want. I'm very demanding in terms of the customization. I'm very demanding in terms of the tasks. Now you do it.”

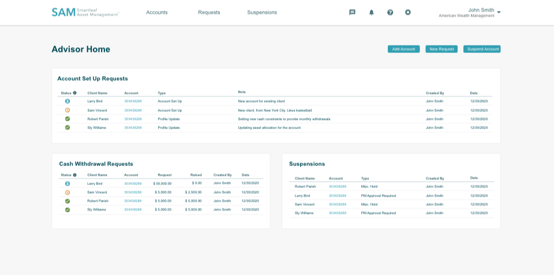

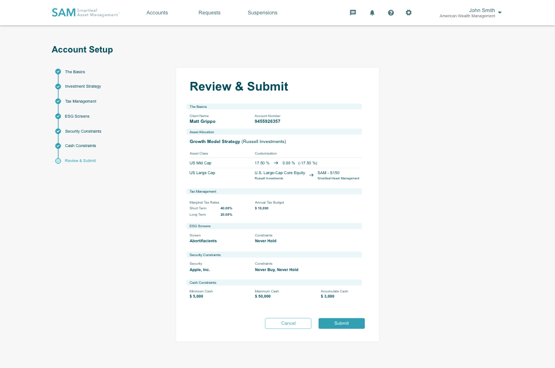

We can show what this interaction looks like by looking at the newest version of the Advisor Portal that our parent company, Smartleaf, is building out.

I'm an advisor. What does my screen look like? Well, I come in in the morning. I have various accounts. I want to look at them but not because I want to trade them, not because I want us to decide whether to sell IBM or buy Ford, but because I have made various requests either to a central rebalancing group or an outsourced rebalancing group. I want to know the status of my requests. We can see here accounts where there's a cash out request. I can see which ones are completed, meaning the cash is there and which ones are still in progress. I may have suspended some accounts. I want to check on that, as well.

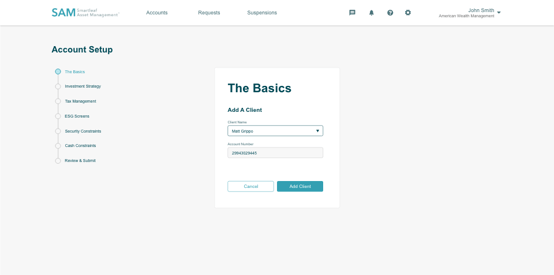

Let's set up an account for a new client, Matt Grippo. I search for Matt. And add his account. Great.

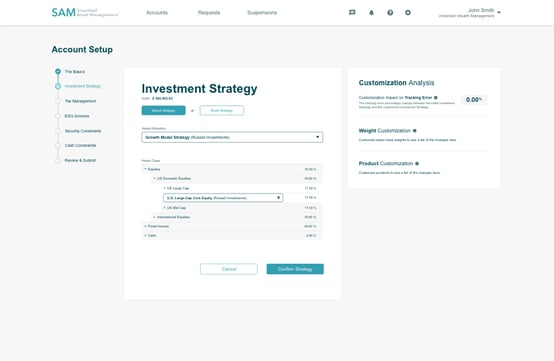

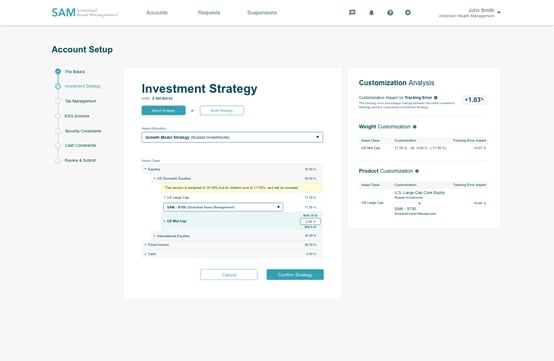

Next, I select a strategy and asset allocation. I'm going to search for a Russell asset allocation strategy. I’ll assign Matt the growth model strategy from Russell. It's 70%/28%/2% equities, fixed income and cash.

I can drill down on the equities. I see it’s both US and international. I can drill further down on the US equities. I see it's large cap and mid cap. I can look under US large cap, and I see the default product selection.

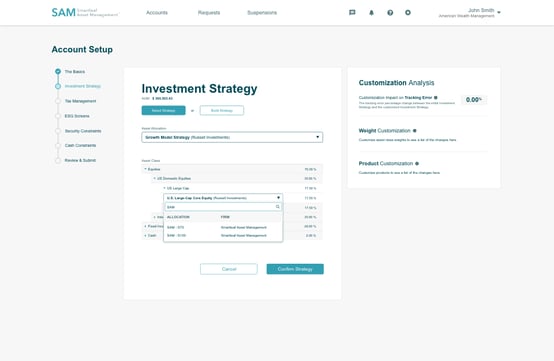

But I want a direct index instead. I look at available alternatives and select a direct index, the SCM-S150, for US large cap.

Next, I look at US mid cap. Targeted weight is 17%.

But Matt has outside holdings of mid cap stocks, therefore I want the mid cap allocation in his portfolio to be zero. At this point, I need to increase the allocation to large cap, but that'll happen automatically. Terrific. On the right, there’s a summary of everything I've done. We asked for the Russell growth model strategy. We asked for no mid cap. We asked for a direct index for large cap. Great. Let’s click “Confirm”.

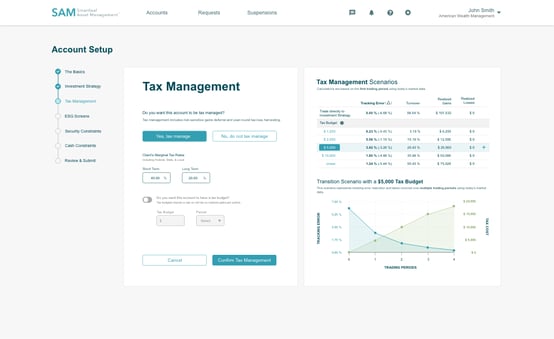

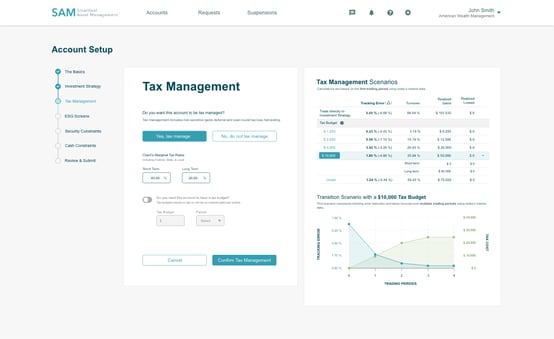

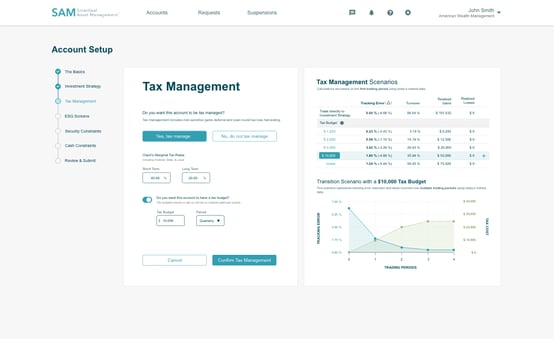

Matt’s account is taxable, so I select that I want tax management. Over on the right, the advisor is shown information on the effect of different tax-budgets, should they choose to have one – the idea of a tax budget is “do whatever you like, but make sure the client doesn't pay capital gains tax per year of more than tax budget.” We can have any value we like, but it’s showing us some summary information on the impact of tax budgets of $1,500, $2,500, $5,000 and $10,000 per period. The $5,000 tax budget is currently highlighted. In the lower right, we see a projection of a multi-period transition plan of $5,000/period. With your first trade you’ll lower tracking error, drift, by about two thirds. In each subsequent period, the tracking error will keep going down. Of course, the cumulative tax will go up, in increments of $5,000 until the tax budget is no longer binding.

I also want to take a look at a $10,000/period tax budget. We can look at the same graph on the lower right and see that with the very first trade, we get an even greater reduction in tracking error. On the upper right, I can drill down on the composition of the capital gains that would be realized and I see that they would all be long-term.

I decide I prefer the $10,000 tax budget, so, on the left, I enter this information. From the graph on the right, my expectation is that it will take about three quarters to full transition. I click on “Confirm Tax Management”.

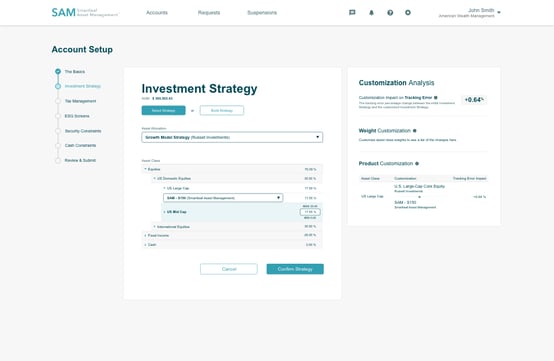

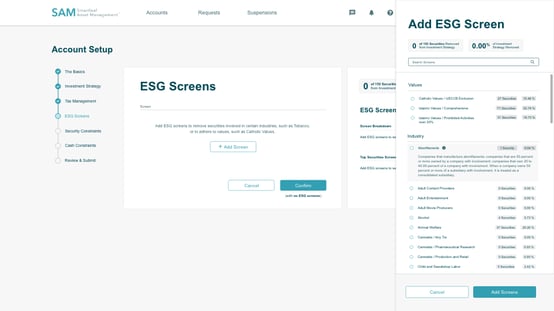

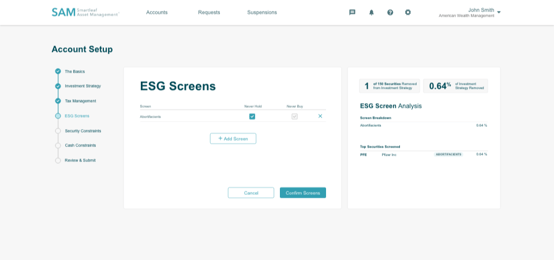

We move onto ESG screens. This client, Matt Grippo, would like an ESG screen, so I click on “Add Screen”, and then I click on “Abortifacients'' and get an explanation of the screen.

I select “Abortifacients” and get a confirmation of a “Never Hold” screen. On the right, I see the impact of my choice: this screen is going to remove Pfizer stocks from the portfolio, which is 0.64% of the model portfolio. So not a great impact.

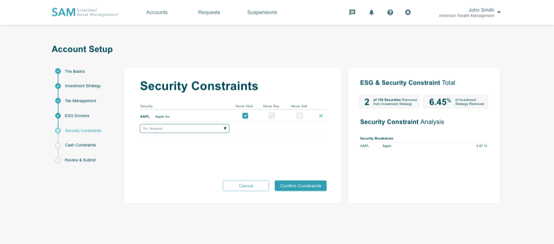

Same idea for security constraints. Here I add a “Never Own” Apple stock constraint. Looking on the right, we see the Apple stock restriction has a bigger impact on the portfolio than the ESG constraint. Apple is 5.81%. Together with the ESG screen, we’re eliminating 6.45% of the model portfolio. It all looks good, so I'll select “Confirm Constraints”.

I add some cash constraints. I’ll skip the details.

We’re almost done. I see a summary of my requests for my new client, Matt Grippo. It looks good, so I’ll click on “Submit”.

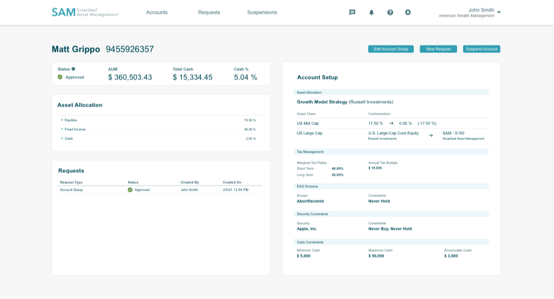

I see the status of the Matt Grippo account. It shows that the account setup has been submitted and approved. And that’s it. I just set up the Matt account. I've asked for tax management. I asked for an ESG screen. I asked for a security screen. I asked that the asset allocation be modified to have no mid cap. I asked to use a direct index for large cap.

Actually implementing all this is somebody else’s responsibility – a central rebalancing group or an outsourced rebalancing group. I, the advisor, no longer have to worry about it. I can move on with my day. I can spend my time with prospects and clients.

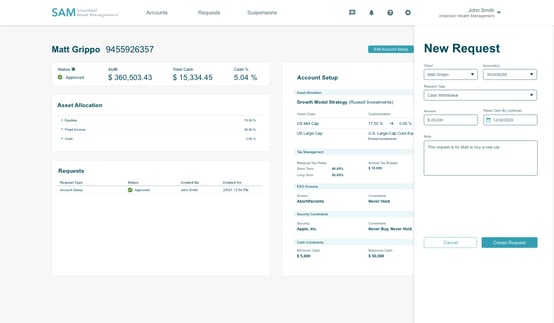

If, at some later time, Matt wants to withdraw cash to buy a car, I click on “New Request” and enter a cash withdrawal request.

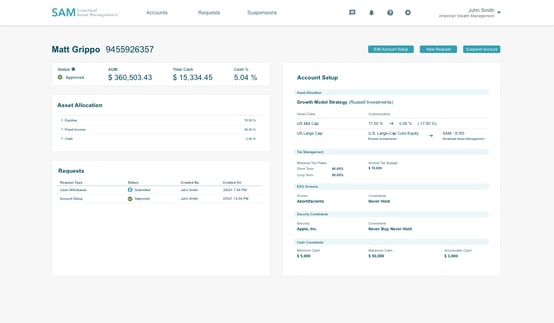

I can then track the status of my cash out request on Matt’s overview page. I see here that the cash withdrawal request has been submitted but not yet completed.

And that’s it. Let me emphasize that the larger point of this demo is not to show our particular solution. It’s to illustrate a new type of advisor workflow.

Doug Fritz: That's a new workflow, but is it also an opportunity when I'm meeting with my clients quarterly to go beyond just talking about the allocation, the models and the managers. Can you pull this up and say “We have these choices. Do we want to change them? Do we want to add things to them? Anything that's happened in your life over the last quarter that we want to have reflected in your portfolio?” Maybe there's additional concentration in real estate. Maybe there are additional concentrations in an outside self-directed portfolio the client manages or something like that. Does this give you an opportunity to have a deeper conversation with clients, not just about performance and allocation and returns, but about other things that are meaningful to them.

Gerard Michael: Yes, I think in two senses.

First, there will be proof statements. We made promises. We kept them. And we can document that we kept them. Proof of tax management, documentation of how much I have saved you in taxes – an amount almost surely larger than my fees. Proof that I reviewed the portfolio every day to make sure, for instance, that I kept my promise not to own manufacturers of abortifacients. This is a non-trivial promise. If there's a merger between two companies and a company that previously wasn't violating that social screen now is, it will be fixed within one day. And you'll have proof of that. In some sense, all of this is just table stakes — of course people should do what they promise to do. But it's non-trivial to be able to prove it.

Second, as you say, there are continuing conversations. Are our customization choices right? Do we want to do more? Do we want to add social screens? What would the impact be of doing so? Would it create a tax hit? Would it make the portfolio riskier?

The larger point here is that the use of direct indexes is linked to a change in role of the advisor. They are much more focused on financial planning, on being a lifetime coach, being the quarterback, the director, the conductor of all this customization and tax.

But direct indexing doesn’t require more effort. Advisors need spend zero time actually managing the direct indexes. That should be handed over to a central rebalancing group or outsourced entirely.

Doug Fritz: But going back to an earlier point, we won't be able to tell a story with direct indexes that I pulled the trigger on this trade, and it was me and me alone. And look how much money I made you by buying Tesla on a dip or something. That part of the story goes away. But there's a whole bunch of additional stories you can tell clients about how much more impactful and meaningful and thoughtful and valuable this portfolio management process is to you as an investor. Most advisors can't tell these stories today because they aren't able to manage the type of tax optimization and levels of customization their clients have asked for.

Gerard Michael: I think that's it. If your practice is about telling that story of why I sold IBM, because of something I read in the Wall Street Journal about their Brazilian operations, if that's what you want your client meetings to be about, if that's what the client is expecting of you, then you direct indexes probably aren't for you. Direct indexes are for advisors who prioritize after-tax performance, risk control, customization, and time — their ability to go beyond talking about IBM trades, to pull the camera back a bit and talk about “What are your goals? “Is this portfolio consistent with your goals?” “Are we on plan?” “Are your investments serving your life well?”

So, ultimately, whether direct indexes are useful goes all the way down to what you want your client experience to be.

Doug Fritz: I love it. I think that's exactly it.

I want to take two questions from the audience — by the way, I do a lot of these things, and this is, by a significant margin, the best group that's actually asked questions at any of these things we've done. So, hats off to attendees. This is awesome.

A couple of questions on the top here. Say we are going to flush out of an ETF-based portfolio, and we're going to move into direct indexing because it's the future. There, there may be embedded gains in those ETF portfolios. So, wait, not so fast there, Doug. I got a tax consequence. How do I think about the transition management process?

Gerard Michael: There is no magic bullet. Actually, I've heard some people mumble about the possibility for very large clients of exchanging your ETF with the market maker and getting the stocks and possibly doing something funny with tax basis, but I don't know if that's actually possible. This type of obscure footnote aside, there may be a real problem. The last thing you want to do is sell something with enormous embedded capital gains and pay an enormous tax bill, all just to get into a tax efficient vehicle. There's something wrong with that story.

So, it may well be that legacy clients end up staying in the ETF. In fact, that's almost surely what we would recommend. Now, if there's new capital, new investments in that account, great. You'll have the legacy ETFs and right beside them, in the same portfolio, direct index holdings. They could be very close substitutes – the S&P 500 as an ETF alongside an S&P 500 direct index.

Fanatically saying, direct indexes are the new, new thing and everyone should sell everything to buy them would violate the deeper principle that portfolios should be customized and every account is different. For some accounts, the right answer is to leave it alone.

Doug Fritz: One more question. This is a really good one from the field looking at this from a marketing perspective and from a sales perspective. Many of the advisors attending this webinar have talked to prospects, shown them a hypothetical portfolio and said, look, this is how this portfolio returned. These are the fund returns, and here are the equity strategy’s composite returns. And it's all GIPS compliant. But boy, when we start customizing every portfolio, the concept of a composite and the concept of the past returns of a strategy, since that strategy is just one ingredient in the pie, goes away. So how do you tell the story? Can you still just use the component strategy returns and say, “in addition to the great returns, the tax alpha is amazing, and we can customize. It's going to hit the same target, the same outcome, but it's more consistent with your ESG worldviews”? What else from a marketing perspective could people do?

Gerard Michael: Two answers. One, you are correct. There are some limitations on reporting here. For some of the customizations, it’s not meaningful to look backwards. Suppose I want a tilt toward green energy. There may not have been that many green energy stocks in the past, so I can't give you the historic track record of a green energy tilt. Of course, the uncustomized portfolio does have a track record, namely the index that you are following. You can certainly talk about that, and you can talk about, as you saw in the demo, the amount of tracking error that this customization might introduce.

But I think there's a more fundamental answer. The more we get away from the idea that the primary skill and the primary role of the advisor is to beat the market, the less important product-level track records become. Advisors will still talk about the track record of the core strategy and the performance of the portfolio. But more and more, that won't be the main thing. Instead, they’ll be talking about “We think the way to maximize the chance of meeting your retirement goal and making sure that you can send your kids to college is a portfolio that has these characteristics. And that’s the portfolio you have. Let me show that to you. What I promise you is that I'm going to monitor that portfolio and make sure it always has the risk characteristics that I say it should have.”

It's a different conversation. The other one is not going to go away completely, but there is a shift. And it's a win for the advisor because there's a “live by the sword, die by the sword” aspect to talking about performance. You can't guarantee it. But you can guarantee the other things. Will you monitor the risk? Yes. Will you implement the ESG constraint? Yes. Will you tax manage? Yes. Those are promises that you can make and be sure that you can keep.

Doug Fritz: I think customization, too, in addition to that. Not just “can you do what you said you're going to do.” We do compete on customization today, and the first advisor in the market to be able to deliver a hyper level of customization with great returns and great tax alpha — that in and of itself becomes this really interesting competitive mode or sort of first mover advantage. Clients that are getting that level of customization are unlikely to go to someone else that is just cookie cutter, even with great returns. Like, “you can't give me the same level of environmental or social perspective in my portfolio? No, I'm good here.” Right?

This is outstanding, but I'm conscious that we're at time. There are so many good questions from the audience. Maybe you and I can spend some time on some answers and make it available offline together with a summary of this conversation.

From my perspective, Jerry, this was fun. It's always fun to do this with you. And I learned an absolute ton, and I hope folks joining us did as well. I really appreciate your putting this on. It's a really valuable thing for people to understand.

Gerard Michael: Well, Doug, an absolute pleasure.

I'm going to take this opportunity to share one more thing. You asked about performance. This is the clever thing that we see people do: they set the level of tax management so that it's roughly equal to the expected level of drift. Drift is random — you could beat the benchmark or you could lose. If you randomly beat the benchmark, you get that random positive performance plus the tax management. If you randomly underperform the benchmark you didn’t lose because you made it up in the value of the tax management. So, you end up in a situation where it’s “heads, I double win. Tails, I don't lose”. This is another way to deal with the customization performance issue. You’re kind of rigging the system in your favor, like a 10-yard head start in the race in the form of the tax alpha. That’s something that we see in the field.

And with that, Doug, thank you so much. An absolute pleasure.

Doug Fritz: You're welcome. Thanks so much.

Gerard Michael: Thanks so much.

The audience submitted lots of great questions, but we did not have time to answer all of them live. We answer them in this Q&A.