Welcome to SAM

We provide a cutting edge rebalancing service that allows you to focus on being your clients

financial coach, while delivering exceptional portfolio management.

With Our Service You Can Offer Your Clients

Flexible Open Architecture UMA

Support any combination of ETFs, Mutual Funds, direct indexes and actively managed equity strategies. Specify your preferred asset allocations and product choices. Leverage a robust 3rd-party model hub, and/or use your own models.

Powerful Customization

Outsourcing does not mean a reduction in customization; it means an increase. There is no limit to the level of customization you can provide each account, including custom asset allocations, custom product choice, ESG/SRI constraints, and sector and security restrictions.

Expert Tax Management

Provide every account with year-round tax-loss harvesting, short-to-long term gains deferral, permanent gains deferral, and tax sensitive transition -- all based on the individual tax rates of each client.

Sophisticated Transition Management

Minimize the disruption of transitioning new client portfolios. Incorporate legacy holdings and implement tax budgets.

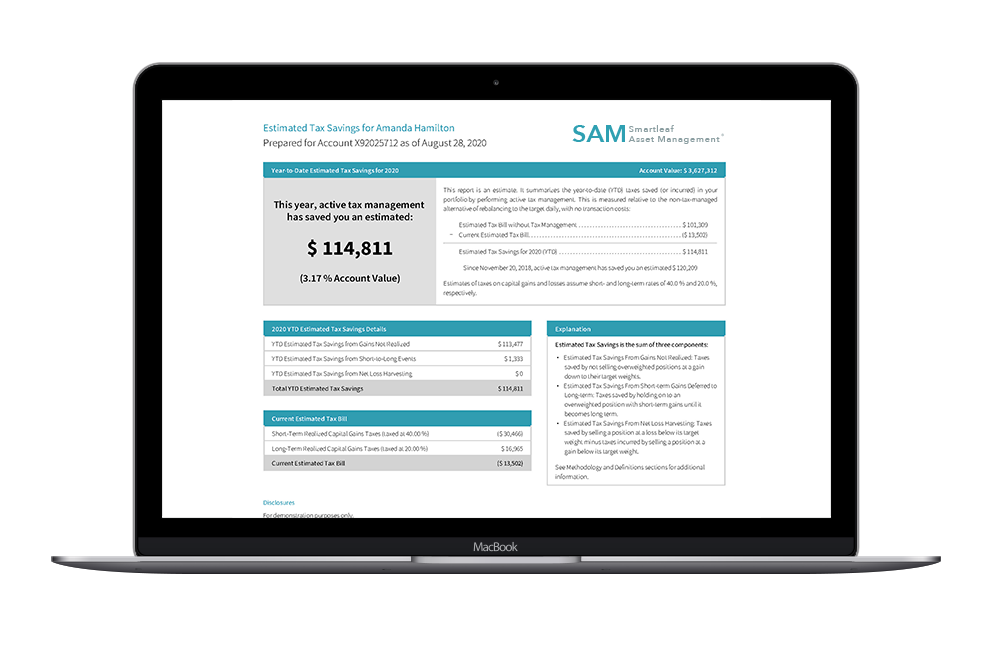

Documentation of Taxes You Save

Go beyond just saying you tax manage accounts. Provide every client with an estimated taxes saved report that documents how much you’ve saved your clients in taxes through active tax management. In 2022, the clients of Smartleaf Asset Management users saved or deferred an average 2.86% in taxes.

Unified Managed Householding (UMH)

Jointly and holistically manage groups of accounts, such as a 401K, an IRA and a taxable account, to a common risk objective, taking advantage of tax-deferred accounts to minimize taxes when rebalancing (minimum account size required).

Document Your Value

Show every client

- How much you’ve saved them in taxes

- That every account is reviewed everyday and managed in a consistent and professional manner to meet the individualized needs of each client