SAM makes delivering personalized and tax-optimized portfolios simple and scalable.

This enables you to provide every client of every size industry-leading tax optimization including tax-sensitive transition, short-term risk-sensitive gains avoidance, long-term risk-sensitive gains deferral, year-round tax-loss harvesting, wash-sale avoidance, tax budgets and optimal tax-lot selection.

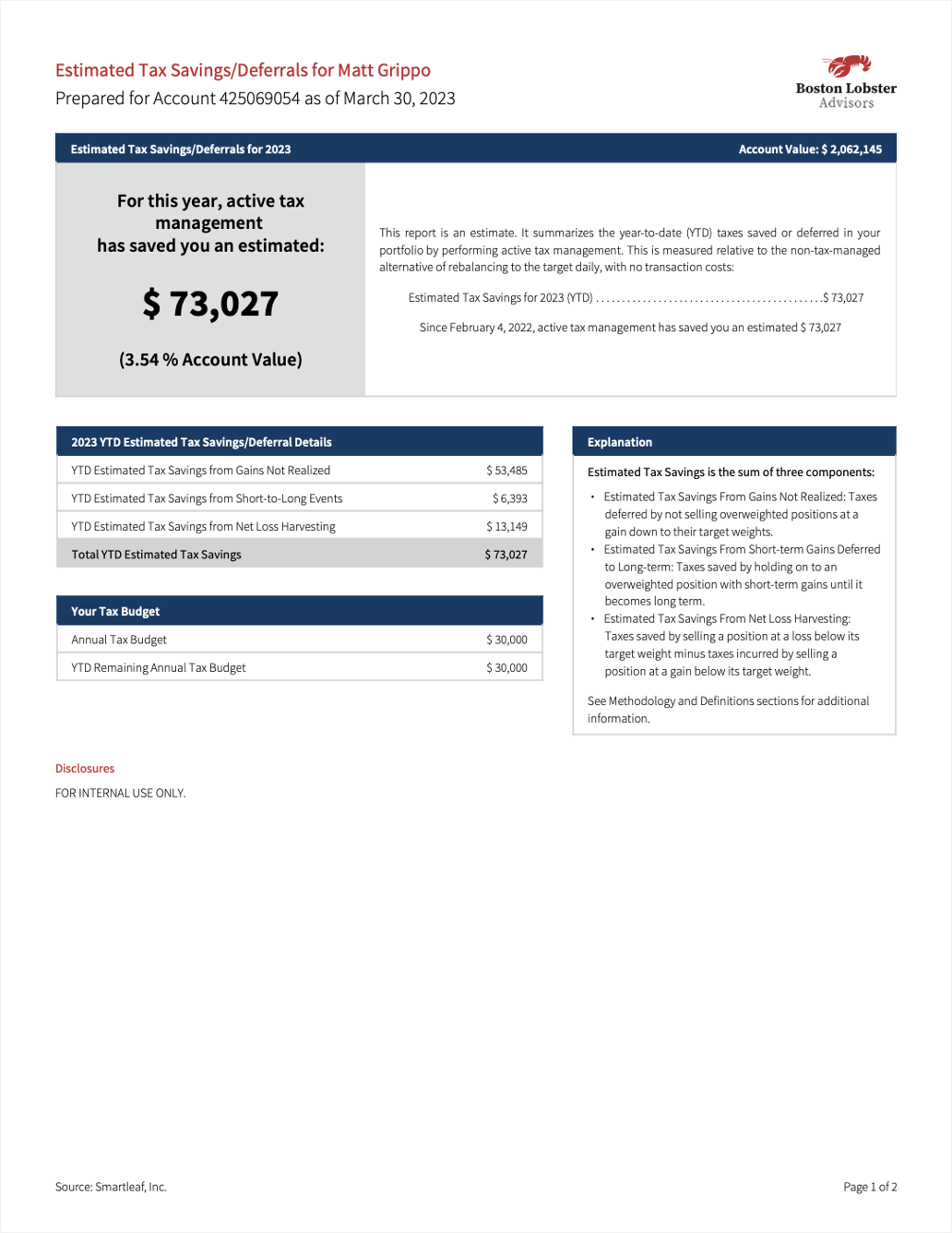

SAM's tax management offering also includes documentation for each account the amount of taxes SAM has saved or deferred through active tax management.

Documenting Value to Clients: The Estimated Taxes Saved or Deferred Report

Documenting Value to Clients: The Estimated Taxes Saved or Deferred Report

SAM's account-level Estimated Taxes Saved or Deferred Report (ETSoD Report) enables advisors to document for each account the value they are adding through active tax management. In 2023, the clients of SAM users saved or deferred an average of 1.68% of the value of assets that were actively tax-managed.

Interview with RIA Channel

Jerry Michael, President of SAM and SAM's parent company, Smartleaf, Inc., joined Keith Black, Managing Director of RIA Channel, to share stories of how Smartleaf technology, the technology used by SAM, has enabled other advisory firms to deliver personalization and tax-optimization at scale — and how this has changed their businesses.