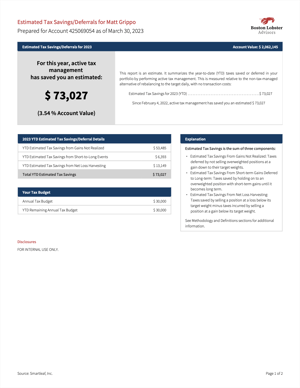

SAM's Estimated Taxes Saved or Deferred Report (ETSoD Report) shows you the amount of taxes SAM has saved or deferred through SAM's active tax management. The ETSoD Report is calculated daily for each account and is accessible through the SAM Advisor Portal.

The report is a comparative tax estimate of the trades proposed by SAM's trade generation system relative to the hypothetical alternative of trading the account exactly to its target model every day. The calculation includes gains not realized (deferred), short-to-long events and net loss harvesting.

Last year, SAM users saved or deferred their clients an average of 2.86% of portfolio value in taxes.