Why asset managers are buying direct indexing firms.

In the last year or so, we’ve seen a slew of acquisitions of sub-advisory firms, mostly direct index managers. Franklin Templeton bought OSAM Canvas, Vanguard bought Just Invest (link), JP Morgan bought OpenInvest (link) and 55ip1 (link), Morgan Stanley bought the parent company of Parametric (link), Schwab purchased the assets of Motif Investing (link), and BlackRock bought Aperio (link).

These acquisitions have put a spotlight on direct indexing (a direct index is like an index ETF, but where the investor directly owns some or all of the securities in the index2). Why all this activity?

The short version is that direct indexes are more customizable and more tax efficient than ETFs, and investors have noticed. Schwab CEO Walt Bettinger stated recently that “personalized investing is coming at all of us like a freight train” (link). Here’s what BlackRock had to say explaining its acquisition of Aperio:

“The wealth manager’s portfolio of the future will be powered by the twin engines of better after-tax performance and hyper-personalization…{We} will bring institutional quality, personalized portfolios to ultra-high net worth advisors and will create one of the most compelling client opportunities in the investment management industry today.” (link)

And here’s what RIABiz had to say about Morgan Stanley buying Eaton Vance:

“Morgan Stanley's Eaton Vance deal yields a golden nugget — Parametric — and a means to own the direct-indexing super trend.” (link)

The “direct-indexing super trend” in the above quote presumably refers to the growing demand for direct indexes. Parametric and Aperio have grown at roughly 20% per year for more than a decade.

With all this as a preamble, let’s take a closer look at what makes direct indexes so attractive (you can also see this video from our parent company, Smartleaf).

The Advantages of Direct Indexes

There are three main advantages to direct indexes: tax efficiency, risk customization and ESG customization.

- Tax efficiency: ETFs are tax-efficient. Direct indexes are more tax-efficient. This is the primary advantage of direct indexes, and it’s worth looking at in some detail.

- Tax loss harvesting: If you purchase an ETF and its underlying index goes up in value, you can’t do any loss harvesting. But even though the index went up, it’s likely that some of the individual securities went down. With a direct index, you can sell those individual losers.

- Gains deferral: If you sell an ETF, you’re effectively selling every share of the underlying index pro rata. With a direct index, you can selectively avoid selling the top gainers.

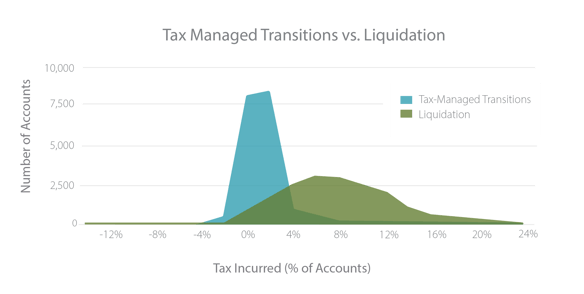

- Transition: Imagine you want to transition a legacy equity portfolio into an index portfolio. If you invest in an ETF, you’ll have to start by liquidating your existing holdings. With a direct index, you can incorporate some of your current holdings into your direct index portfolio. The only trades you need to make are those required to reduce concentrations and fill in missing sectors. The difference in tax efficiency can be striking. Our parent company conducted a hypothetical study that compared the tax impact of liquidation vs tax sensitive transition for the large-cap individual equity holdings of 18,000 investor portfolios being managed by the parent company’s clients. (The study made various assumptions about the investment strategy being pursued, the applicable tax rates, and other matters. See important disclosures in the footnote below).3 The difference? Selling off all the equities and buying an ETF would cost investors an average of 7.21% of portfolio value in taxes. Transitioning to a direct index in a tax-sensitive manner would cost an average of only 0.29% of portfolio value, though with larger tracking error to the index. Here’s the graph:

- Tax loss harvesting: If you purchase an ETF and its underlying index goes up in value, you can’t do any loss harvesting. But even though the index went up, it’s likely that some of the individual securities went down. With a direct index, you can sell those individual losers.

- Risk customization: Suppose you work in the energy sector and you’d therefore like to underweight energy in your portfolio. You can’t do that with a broad-index ETF — you can’t ask for SPY minus the energy sector. But you can do it with a direct index. Like all separately managed accounts, the holdings can be customized to meet individual investor needs.

- ESG/religious values criteria customization: The same story applies to ESG constraints. You can’t ask for SPY minus tobacco stocks and firms with poor governance records. You can with a direct index.

We see the market for wealth management services moving away from a “beat the benchmark” value proposition. In its place, investors will demand more value, which includes tax management, risk customization and impact investing.

The Technological Advances Behind Mass Market Direct Indexes

There’s a back-to-the-future quality to direct indexes. Owning baskets of stocks long predates the invention of the mutual fund or the ETF. Direct indexes themselves have existed for decades. What’s new is that while direct indexes used to make sense only for ultra wealthy investors, they're now affordable and practical for ordinary investors. That is, what’s new isn’t the concept of direct indexes. It’s that they can now be offered at a price point that makes them a superior alternative to ETFs for most investors. The technological innovations that have made this possible include:

- Lower transaction costs: Bid/ask spreads and commissions are 1/10 or 1/100 of what they were 30 years ago. Baskets of stocks were prohibitively expensive for most investors. Large players, like mutual fund companies, used to have a large advantage over individual investors in executing trades at low cost. Now, this is sometimes reversed; individual investors, who don’t need to worry about moving the market, can now sometimes get better execution than mutual fund companies. We’re seeing very low, even free, commissions, and we’re seeing trading and custody packaged for under 4 bps.

- Rebalancing automation: The tax and customization advantages of direct indexes are impressive, but they’re not automatic. You’ve got to actively manage a direct index portfolio to get tax savings and implement constraints. Traditionally, this was done by a highly compensated portfolio manager. But with sophisticated rebalancing systems these tasks can now be automated.

- Fractional shares: For portfolios smaller than $50,000, the need to buy whole shares can distort direct index portfolios, resulting in excess tracking error to the target benchmark. Multiple brokers offer fractional-share trading, making it technically feasible to manage and rebalance direct index portfolios to investors with as little as $50.

At heart, the case for direct indexes is simple: higher after-tax expected returns and more customization. That answers the question of why. But it still leaves open the question of how. How do wealth managers go about incorporating direct indexes into their day-to-day operations? We’ll take up this issue in our next post.

SAM and direct indexes

SAM manages direct index portfolios for wealth managers. SAM offers both direct index separately managed accounts (SMAs) and unified managed accounts (UMAs) with direct index cores. With UMAs, the client wealth advisory firm retains control of asset allocation and product choice — including the option to subscribe to third-party asset allocation models. (SAM recently announced that it includes in its base offering asset allocations and direct index portfolios tied to Morningstar indexes.)

155IP is not currently a direct-index provider, but it does focus on tax management.

2The term “direct index” is sometimes used to refer more generally to the idea of unbundling or “unwrapping” mutual funds and ETFs, regardless of whether the strategy is literally following an index. In this sense, “direct index” basically means the same thing as a separately managed account (SMA), though perhaps less tethered to the specific implementation structure typically associated with SMAs.

3Important disclosures: The results of the study are not the actual results of any account. The results will vary considerably for any given account, depending on many factors, such as the investment strategy, the number and size of the existing equity holdings, the age of tax lots, the applicable marginal tax rate and many other factors. The results of this study should not be regarded as a prediction of the benefits of pursuing a tax-sensitive transition through direct investment vs. liquidation and the purchase of an ETF. For the purposes of the study, every investor was assumed to have tax rates of 20% on long term gains and 40% on short term gains, and trading costs were ignored. A liquidation/ETF transition results in a tracking error of close to zero. In contrast, the accounts that were transitioned to a direct index in a tax sensitive manner had an average tracking error of 1.54%. Therefore, a critical component of effective tax management is consideration of the trade-off between tax efficiency and fidelity to the target index.